| Match | Win | Odds |

|---|---|---|

| 5 numbers and the Lucky Ball | $1,000 A Day For Life | 1 in 30,821,472 |

| 5 numbers but not the Lucky Ball | $25,000 A Year For Life | 1 in 1,813,028 |

| 4 numbers and the Lucky Ball | $5,000 | 1 in 143,356 |

| 4 numbers but not the Lucky Ball | $200 | 1 in 8,433 |

| 3 numbers and the Lucky Ball | $150 | 1 in 3,413 |

| 3 numbers but not the Lucky Ball | $20 | 1 in 201 |

| 2 numbers and the Lucky Ball | $25 | 1 in 250 |

| 2 numbers but not the Lucky Ball | $3 | 1 in 15 |

| 1 number and the Lucky Ball | $6 | 1 in 50 |

| Only the Lucky Ball | $4 | 1 in 32 |

Overall odds of winning a prize are 1 in 7.8

Top Prize 5 + 1

(1) Minimum top-prize payment period is 20 years. Top prize winners may choose the Cash Option as an alternative to the Annuitized Payment Option. The top prize amount shown is based on one winning ticket. The top prize values governed by "split-prize" liability; the top prize is divided equally among the top prize winning tickets and may be less than shown.

Second Prize 5 + 0

(2) Minimum second-prize payment period is 20 years. Second-prize winners may choose the Cash Option as an alternative to the Annuitized Payment Option. Second prize amount shown is based on one to twenty winning tickets. Second prize values governed by "split-prize" liability; the second prize is divided equally among the second prize winning tickets and may be less than shown.

Third Prizes 4 + 1

(3) The $5,000 prize value is guaranteed to 1,000 winning tickets. If the number of winning tickets exceeds 1,000, the total prize liability of $5,000,000 is divided equally among the winning tickets. The minimum prize value for this category is $200.

All prizes are rounded to the nearest dollar.

Please read the Lottery Ticket Security Tips for information on how to protect your winnings.

Frequently asked questions about claiming a prize of $600 or more.

Players have 60 days from the date a winning ticket is validated and claimed to choose the cash or annuity option. Federal (24 percent) and state (5 percent) taxes are mandatorily withheld before the prize is paid. Players' ultimate tax liability may be more or less than the amounts withheld.

Annuity Option: Players will receive prizes in graduated payments over the next 29 years (30 payments), less taxes. The jackpot amount advertised by the Lottery is the annuitized amount.

Cash Option: Players will collect prizes in one payment, less taxes. The lump sum cash payment is the amount available to the Lottery for the jackpot prize pool. It is approximately half the estimated annuity option jackpot, depending on current interest rates. This dollar amount represents the same amount of money the Lottery would have invested in an annuity.

Players have 60 days from the date the winning ticket is validated and claimed to choose the cash or annuity option. Federal (24 percent) and state (5 percent) taxes are mandatorily withheld before the prize is paid. Players' ultimate tax liability may be more or less than the amounts withheld.

Annuity Option: Players will receive prizes in payments over the next 29 years (30 payments), less taxes. The jackpot amount advertised by the Lottery is the annuitized amount.

Cash Option: Players will collect prizes in one payment, less taxes. The lump sum cash payment is the amount available to the Lottery for the jackpot prize pool. It is approximately half the estimated annuity option jackpot, depending on current interest rates. This dollar amount represents the same amount of money the Lottery would have invested in an annuity.

Players have 60 days from the date the winning ticket is validated and claimed to choose the cash or annuity option. Federal (24 percent) and state (5 percent) taxes are mandatorily withheld before the prize is paid. Players' ultimate tax liability may be more or less than the amounts withheld.

Annuity Option: Players will receive prizes in payments over the next 29 years (30 payments), less taxes. The jackpot amount advertised by the Lottery is the annuitized amount.

Cash Option: Players will collect prizes in one payment, less taxes. The lump sum cash payment is the amount available to the Lottery for the jackpot prize pool. It is approximately half the estimated annuity option jackpot, depending on current interest rates. This dollar amount represents the same amount of money the Lottery would have invested in an annuity.

All prizes up to $599 may be claimed at most Kansas Lottery retail locations, regardless of where the ticket was sold. Some stores have certain times when they can cash larger prizes or have limited cash on hand, so be sure to tell the clerk the amount of the prize before the ticket is validated. Prizes may also be claimed at Kansas Lottery headquarters in Topeka. A claim form is required for prizes of $50 or more claimed at a Lottery office, whether in person or by mail.

Prizes over $599 must be, and all lesser prizes may be claimed, at Kansas Lottery headquarters in Topeka. Players must complete a claim form for prizes of $600 or more. Bring or mail the signed ticket and completed claim form to the Kansas Lottery office. Prizes of up to $5,000 can be claimed and a check received the same day.

Bring or mail the ticket and a completed claim form to the Kansas Lottery office. The Lottery is unable to issue you payment the same day you submit your claim on claims above $5,000. A check will be mailed to you, you may pick up the check later, or you may request an electronic deposit into your bank account. Please allow 7-10 days for mailed payments or electronic deposits. The payment will be for the prize amount, less mandatory withholdings of 25% federal tax and 5% state tax. Players' ultimate tax liability may be greater or lesser than the amounts withheld. Winners will receive a W2-G the next year to file with their taxes.

For electronic deposit please contact the Finance Department at 785-296-5734 to obtain a direct deposit form. A voided check is also required for electronic deposit.

No, only one individual can claim a lottery ticket. Therefore, a group will have to designate one person to claim the prize. The remaining group members will need to complete and sign the Multi-Winner form, enabling the Lottery to properly report winnings to the appropriate taxing authorities. The Lottery must receive the Multi-Winner form by December 31 of the year the prize is claimed.

Draw tickets - Players have 365 days from the drawing date on the ticket to claim a prize.

Instant tickets - see the list of expired instant games to find the expiration date for that game.

These forms are available at Kansas Lottery retailers or at the Lottery office. Be sure to make a copy for personal records. You can also download a claim form in a pdf format.

For the address of the Kansas Lottery office, visit contact us.

All prizes of $50 or more claimed at a Kansas Lottery office are subject to the Kansas setoff program. If you owe back taxes, child support or certain other debts, that money will be withheld from the prize amount.

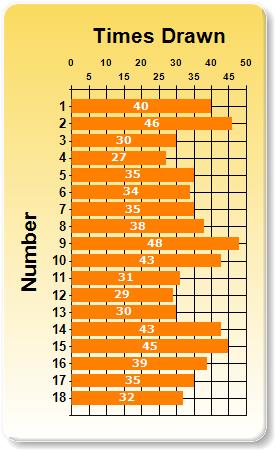

White Ball

|  |

Lucky Ball

|  |